Investing is a great way to grow your money. It can help you build wealth, achieve financial independence, and network with different experts and business owners.

However, investing can be a bit of a scary prospect when you are not sure what you are doing. There are a lot of risks involved with investing, and you could lose not just money but also time, network, and other resources. Likewise, an entrepreneur should always be careful in investing, especially startups.

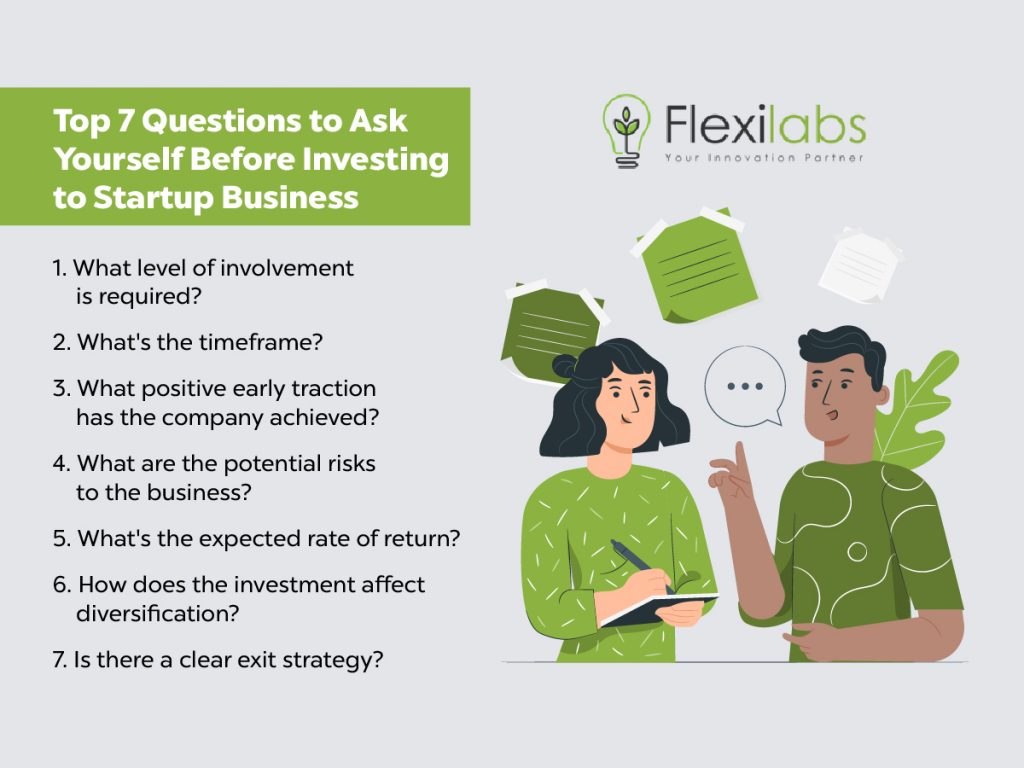

So before diving into an investment, you should learn the basics like understanding what the acquisition consists of, the people who will handle it, and how it works. This article will give you the basic information of 7 questions to ask before investing in a startup.

Why is it important to evaluate before investing in a startup business?

Investing in a startup, like life, is full of risks, surprises, and miracles. There are ups and downs and challenges left and right. And you always want to be the one maneuvering through all these traps to ensure that everything is going right.

Likewise, it is essential to evaluate every bit of the pieces of startups before entirely investing. You need to know that the company will be around for a long time. You also want to make sure that the company has a product or service that people will buy, and they can make it profitable.

The evaluation process is critical to the success of any startup. Investors need to be able to evaluate a startup before they invest in it. They also need to ensure that they are not investing in a company with no chance of success.

It is why evaluating startups before investing in them is so important. It helps founders and investors identify the most promising startups and avoid wasting time on those with a low probability of success.

What are questions to ask before investing in a startup business?

As mentioned earlier, Investing is a significant decision and should not be taken lightly. More so, investing in a startup company comes with considerable risk. So before investing, it’s essential to do your research and find information about the company, the product, the industry, and the market.

Here are some questions you should ask yourself before investing in a startup.

1. What Level of Involvement Is Required?

Investing in a startup business can be a great way to grow your income. However, it would not be easy. A startup requires a lot of thinking, planning, and execution. It could take a considerable amount of your time that you don’t have.

One of the most crucial questions to ask before investing is the level of involvement in the business. As an investor, you should consider what level of involvement is required and how much time commitment it will take up. In addition, you need to be aware of what is expected from you to make an impact or any tasks you need to do in the startup.

You can measure the level of involvement by asking these four questions:

- What are your thoughts about the industry?

- How much time will you need to spend on the startup?

- What is the story of the risk involved?

- What are your expectations from the company?

2. What’s the Time Frame?

Investing in a startup is an exciting prospect. However, as mentioned earlier, it could be time-consuming with all the development and growth of the business. As such, it’s one of the top questions to ask before investing in a small business is the time frame.

The time frame is essential when investing in a startup because it tracks the startup’s progress. Investors should always look at the Timeframe of a startup before investing. It can help them identify if the startup will be successful and how much time until the investor receives their ROI.

Likewise, a timeframe can also help you weigh the risks of your investment. For example, if an investor is looking at two startups with the same trouble. Both have an equal chance of succeeding, but if one has a shorter timeframe than the other, that would be more appealing because the investor will get their money back faster and less risk.

The Timeframe can be anything from years to months, and it will have a significant impact on your investment. If you invest in a company that is just starting, then your investment will have a higher risk than if you invest in a company that has been around for years.

3. What Positive Early Traction Has the Company Achieved?

Positive early traction in a startup means a lot of things. It can indicate the startup’s success or signify that a product has a potential market. It is also great insurance for investors that this startup will gain revenue later.

Likewise, when investing in a startup company, one question is if it experienced any early traction. It is essential to see if the startup company has positive early traction before investing in it. It is because a company that has not yet been tested will not be able to provide reasonable returns on investment.

4. What Are the Potential Risks to the business?

One of the top reasons startups usually fail is because they abandoned looking at the risks of the business or the industry they are trying to engage. Risk, in any investment, is inevitable. But knowing the risks can help you minimize its effect and prevent it before it hits your business.

So before investing in a startup, make sure to research any potential risks to the business. If the company is not well established and has no track record, you should look at the market they are trying to enter.

Likewise, suppose they are entering a crowded or saturated market. In that case, there will be more competition, and the business may not last. And consider the company is entering a new market. In that case, it could be more difficult for them to make money because of their lack of experience in that area. It would help to look at how much money they have raised so far and their burn rate.

5. What’s the Expected Rate of Return?

Another most essential questions to ask before investing in a startup is the expected return on investment. You need to know how much the return is to evaluate whether it is worth investing or not. With this information, you will be able to consider the risk and the potential return of your investment.

Moreover, the ROI date is when the company expects to get back its investment or break even. It has a significant impact on the decision-making process for companies.

6. How Does the Investment affect Diversification?

Another factor to consider before investing in a startup is Diversification. Diversification is essential for long-term investments. It is because it reduces the amount of risk that investors take.

Investors should ask themselves a few questions before making an investment decision, such as

- Is this a diversifying investment?

- How does this affect my Diversification?

- What are the potential risks and rewards of this investment?

- What are my alternatives to investing in this asset?

- Am I over-invested in one sector or under-invested in another?

7. Is There a Clear Exit Strategy?

Lastly, another essential question to ask before investing is if they have a clear exit strategy in the contract. An exit strategy is vital as it gives you a way to reduce or liquidate your stake in the business.

The most common forms of exiting a trade are through an IPO, acquisition, or sale. Exit strategies are essential as they help investors plan for their exits and can also be used to mitigate downside risk for investors.

Exit strategies are necessary as it allows investors to minimize downside risk for investors.

The Bottom Line

Investing is risky, but it can be great with enough research. It is not hard to find opinions on the topic of investing. Some people will tell you that it is a great idea, while others will tell you it’s a terrible idea. Regardless of your opinion on the matter, one thing is sure: investing can be rewarding.

So make sure to do your research and evaluate the startup before investing. And if you are unsure, tell us about the business so we can help you improve it! Invest in a startup today!