How much should you pour in for your business investment? That is one of the most important questions that always comes up for new entrepreneurs or seasoned business owners.

To have a profitable business is the end goal for any entrepreneur. It is concrete proof that in every hurdle and challenge that has come your way, you have overcome it.

In this article, we are sharing tips on how much you should put into business investment and where you can put it. So if you finally pick one from the countless business ideas or you are just about to set up your startup business, investing in your business would be easier.

Why Business Investments Are Important

All business ideas need funds to become a reality and ultimately turn into profitable businesses. One way to achieve that is through business investments.

For new entrepreneurs, it is a fulfilling and euphoric feeling to see your business earn profit. But, for it to grow further and become eventually successful, it is important to put some of the hard-earned money into business investments.

So how do you invest in your business? If you are new to investing, here is a quick introduction to business investment to give you an idea:

Risk And Opportunity

Where there are risks, there are always opportunities—these go hand in hand.

Risk refers to the uncertainty of investing, particularly the adverse events that affect your financial welfare. At the same time, an opportunity is earning something from the investment, whether it is tangible or intangible.

In the context of new entrepreneurs and business owners, the risk is the potential loss of profit. On the other hand, the opportunity that business investments provide is the potential for higher potential profit.

Fundamental Analysis

According to Investopedia, fundamental analysis, or FA, is the process of measuring the intrinsic value of an asset or company.

An asset or a company’s value is gauged by using metrics and assessing internal and external factors, such as business management, capital structure, market value, and other relevant economic and financial aspects.

Fundamental analysts do these to get a better idea of an asset or company’s current or project worth for investment.

Technical Analysis

On the other hand, technical analysis focuses on past trading or investment activity for an asset or company. These enable technical analysts to identify potential trading opportunities and assess the price movement and volume for investments.

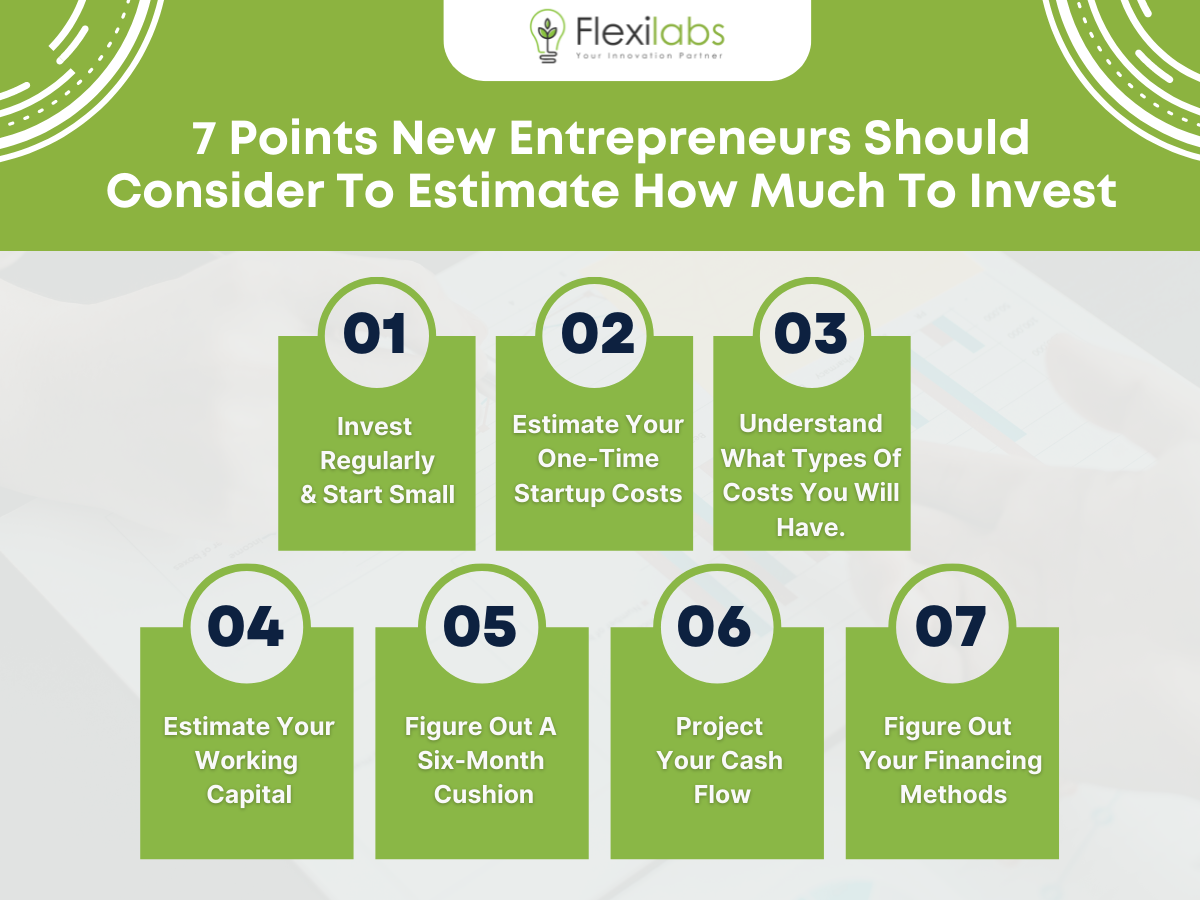

7 Points New Entrepreneurs Should Consider To Estimate How Much To Invest

For new entrepreneurs, figuring out the best business ideas that suit them is not the only thing to think about. There is a lengthy checklist for new entrepreneurs to do for their startup businesses. One of these is figuring out the number of business investments needed to keep going and become profitable.

As a general rule of thumb for investing, you would normally follow the 50/15/5 rule, where 15% of your funds you put for investments. However, it might not be that straightforward for business investments, especially if it is concerning your business.

To give you a better idea of how much money you should put into business investments, here are a couple of points you should factor in:

1. Invest Regularly & Start Small

All efforts accrue over time—this is especially true for investing.

One-time investments will grow, but they will be slow and not to the size or amount you wish them to be. The same goes for business investments, the difference is that it will be hard for you to grow your company into a profitable business if you just relied on your initial capital and profits.

Investing regularly in business investments lets you improve aspects of your company. It does not have to be a big investment, it can start small and then grow by increments as you have more cash flow.

2. Estimate Your One-Time Startup Costs

List all the things you will need immediately to get started with your business. These should not be recurring transactions. An example of this would be your laptop, printer, and office furniture—items that are considered one-time costs and used consistently.

3. Understand What Types Of Costs You Will Have.

There will be various types of expenses you will make when you establish your startup business. Identify what these are early on. That way, keeping track of all transactions and managing the cash flow would be easier.

Here are the costs you should take note of:

- One-time costs are one-time purchases that are most relevant during the startup process.

- Ongoing costs are regular transactions, such as utilities.

- Essential costs are expenses necessary for your business’s growth and development.

- Optional costs are expenses made only when the allotted budget allows it.

- Fixed costs are consistent expenses, normally on a month-to-month basis or yearly, like rent.

- Variable costs are expenses entirely dependent on the sale of products or services.

4. Estimate Your Working Capital

Once you have identified and understood the types of costs you will make for your business, it would be a lot easier to estimate your working capital.

Your capital should be sizeable enough to cover the monthly expenses, such as:

- Rent

- Utilities

- Payroll

- Taxes

- Marketing budget

While you can do this alone, it would be easier to consult with your accountant, business consultant, or possibly even your mentor if you do have one.

5. Figure Out A Six-Month Cushion

Aside from the capital to keep your business going, you should also look ahead into the future.

For new entrepreneurs, the focus should not only be on keeping the business afloat in the present. It would also be about future survival. For that to happen, you need a cushion that will tide you over for at least six months—better if it is for a year.

The point of the cushion is to lessen the pressure on new entrepreneurs on the operating expenses and stay on top of the finances.

6. Project Your Cash Flow

Next is to project your cash flow. This is an important step to ensure your business is financially healthy. It provides a better idea or floor to the financial aspect of your business and serves as a gauge when you need to put more money into your business investments.

Be realistic with your cash flow. Add up the fixed costs to the best- and worst-case revenues for the next three to six months.

7. Figure Out Your Financing Methods

Now you have the numbers panned out. Next, you need to figure out how you will finance your business investments.

There are plenty of options, you can do a little bit of it all to get the funds you need:

- Personal savings

- Salary from a 9-5 job

- Family and friends’ loan

- Government loan

- Bank loan

- Government grants

Smart Investments For A Profitable Business

Traditionally, you can also follow the rule of thumb to reinvest 50-70% of your profit back into the company. Just keep in mind this serves as a quick guide to investment.

Regardless of the amount you dedicate to business investment, the important thing is where you invest it.

This is dependent on your immediate goals and target. Where you put your business investment or how you allocate it will help you turn your startup into a profitable business.

So where exactly? Here is a couple of you can reinvest in first:

- Invest In People

- Improve Your Technology

- Ramp Up Sales And Marketing

- Acquire New Capabilities

How Much Should You Pour Into Your Business Investment?

Some may say follow the 50/15/5 rule. Others may even advise you to go with 50-70% of your company’s profits. There is no set rule on how much you should actually pour into your business investment—it is entirely up to you.

To be more specific, it is up to the direction where you want to lead your company. What are the targets you want to achieve or the immediate goals you set for yourself?

That said, what you should not overlook are the factors that will keep your business going right now, in the next couple of months and the funds to help your startup grow.

Just remember to factor in the “now” and “later” and be realistic when you do invest in your business.

There are hundreds of brilliant business ideas, but only a few actually become money-making ideas. Find out how you can turn your idea into a business by visiting our website.