So, you are thinking of opening your own small business?

First things first: Congratulations to you! It is not an easy path but it can be very rewarding when it works out and continues to thrive.

However, for that to happen, you will need business funding. Yes, you can fund it yourself. But the reality is it might not be enough.

So what do you do?

Ask for funding from lenders and investors to get the funds you need. It can help keep your company going like the training wheels on a bike while you are still starting out.

In this article, we will help you understand what a funding request is so that you can write one to your future investors:

What Is A Funding Request?

Why is it so important for your small business?

First off, what is a funding request? It is literally a written request that you send to potential lenders convincing them to invest in your small business. If they approve of your request, they will be the ones that will supplement you with much-needed business funding.

Why is it important? It is a way to ensure that your business does succeed even while you are still getting your business “sea legs.” It gives your potential investors a good look at your business now, where you are headed, and what you need to get there.

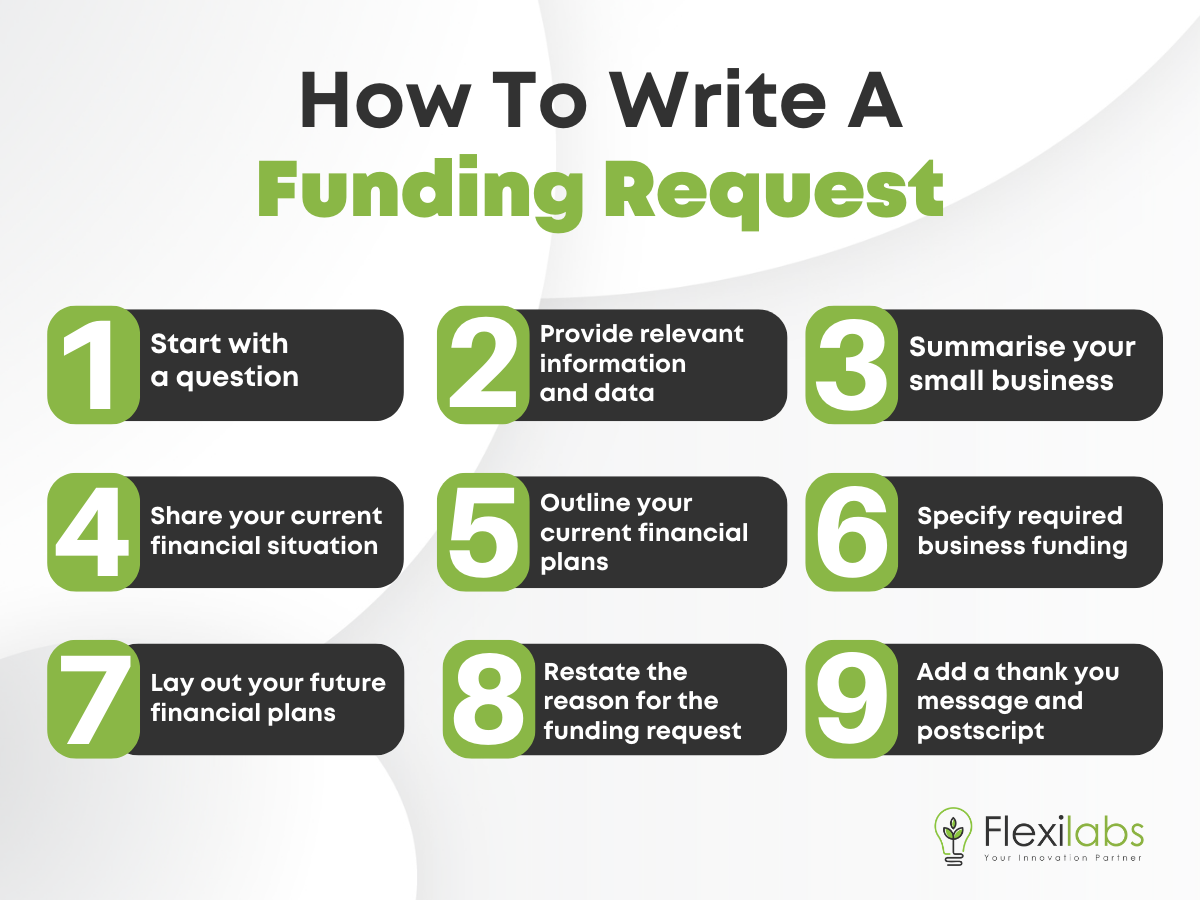

How To Write A Funding Request

Now that you are familiar with funding requests in business plans, what goes into writing them? Here are a couple of things you need to add:

Start with a question

The question you should start with should be a simple question that is answered with a “Yes” or “No.” No need to complicate it with an open-ended question.

Provide relevant information and data

Next, tie in your question with relevant information about the current state of the industry you are in. Make sure to highlight the stability and growth of the industry and the success rate.

Summarise your small business

This clearly gives your potential investors and lenders a clear picture of your small business. Since you are already done with this part, you can easily just copy-paste this. But if you want to make it more personalised, you can also highlight your company’s projected growth.

Share your current financial situation

You need to let your potential lenders and investors know how much you need the business funding. Letting them know your money situation, such as all income sources, cash flow, and balance sheet.

Outline your current financial plans

Along with the current financial situation of your small business, you should also include details of your financial plan:

- Recent loans or are currently in debt

- How much do you need to pay off the loan

- How long do you need to pay the loan

- The method of how you are going to pay off the loan

Specify required business funding

Now, this is the heart of your funding request. For this, you need to include a ballpark figure of the total business funding. As a rule of thumb, businesses usually account for up to five years to estimate how much you need.

Aside from that, make sure you specify the following:

- Duration of the loan (as needed)

- Investment amount

- Exchange for the investment

Remember, it is better to ask for more rather than be humble and ask for less. This is for your small business, so every penny counts.

Lay out your future financial plans

Here, you need to specify what you will do with the business funding. Make sure you answer the following questions for this portion:

- How are you going to utilise the money?

- What is the potential return on investment?

- What are your target goals or numbers?

- How much will you allot for unexpected events?

Restate the reason for the funding request

Once you have the important details, close the letter by restating your reason. Remind your potential lenders and investors how much their financial assistance would mean for your business.

Add a thank you message and postscript

Lastly, thank your potential investors and lenders for taking the time to read your letter and consider investing in your small business. Then, end the letter with a respectful tone. It can be a simple “Respectfully,” “Best regards,” or “Sincerely yours.”

Important Tips To Remember For Your Small Business

Before you start creating a funding request, here are a couple of tips on how to write your letter. These are just a couple of things you need to remember that your potential lenders and investors will appreciate:

Be Professional

It goes without saying that you should adopt a professional tone in your letter. First, it is out of respect to the people you will be writing to, and second, it is to create a good impression.

Before you send your letter, make sure to check the following:

- Grammar

- Formatting

- Tone

- Signatures

- Active Voice

- Conciseness

Do Your Research

You will be sending a lot of letters to different potential lenders and investors. So, research everything about your potential lenders and investors.

There are plenty of options for you to choose from. Doing your research will help you narrow down and identify a couple of things:

- Industry of the investor

- Business funding limit

- Requirements

- Good fit for your small business

Tailor Your Letter

While it would be easier to create a template, an added personalised touch to your letter would be much appreciated. Since you already did the research, you can tailor-fit your letter to a specific lender or investor.

Bring Documents

Whether it is a bank or an angel investor, they will ask for information. That means lots and lots of your documents. To save yourself save time and effort later, you should prepare the following already:

- Income statement

- Cash flow statement

- Balance sheet

- Statement of retained earnings

- Personal financial statements

- Business licences and permits

- Ownership and/or affiliate documentation

- Business loan or mortgage information

- Loan application history

Just remember to update all financial records before you share the documents.

Share Details

Your potential lenders and investors are investing based on your small business’ potential. Basically, they are coming in blind. And since nothing is for sure, they are heavily relying on the information you share

So, share as much information as possible. Convince them by making yourself a trustworthy figure.

Be Realistic

We mentioned earlier that it is better to ask for more since every penny counts. However, you should still be realistic when asking for a specific business funding amount.

If it is for a business loan, make sure you consider the following things:

- Can you afford to settle the loan within five years?

- What is the comfortable range for interest rates?

- How will the loan repayment affect your usual back-end business transactions?

If it is for investors:

- What is the maximum percentage are you willing to give to investors

- If an investor gives X amount of money for 50% or above, how would you feel?

- Are you ready to give up a degree of control?

Funding Requests Can Be A Win Or Lose—And That’s Okay!

Funding is a win-or-lose situation whenever you send a funding request to potential investors and lenders. That is okay—it happens.

You already overcame the first hardest hurdle: Starting your own small business. This is just a small bump in your journey. The important thing is you do not give up until you get the business funding you need.

Though it will be helpful, you do not need to be a savvy proposal writer and master persuader. You just need to share the important details and show that you are worthy of investment.

Do you believe the more you learn, the better you get? Explore our website and learn more about the tried-and-tested tips to start your own business.